Business Funding Without Guesswork!

Struggling to Secure Business Funding, Credit Lines, or Startup Capital—Even With a 700+ Credit Score?

You’re not alone. Most business owners are denied funding not because they’re unqualified—but because their credit profile, business structure, and lender positioning are misaligned.

E & A Consulting Group LLC helps entrepreneurs secure:

Business Credit & Funding (with or without revenue)

LLC & Entity Structuring for Fundability

Personal Credit Optimization for Business Leverage

Lender-Ready Profiles that Banks Actually Approve

Funding is not guaranteed. Qualification is required. Complete the Business Funding Qualification Form

Find out if you qualify for business credit, capital, or funding programs today.

Our Trusted Partners

READY TO GIVE US A TRY?

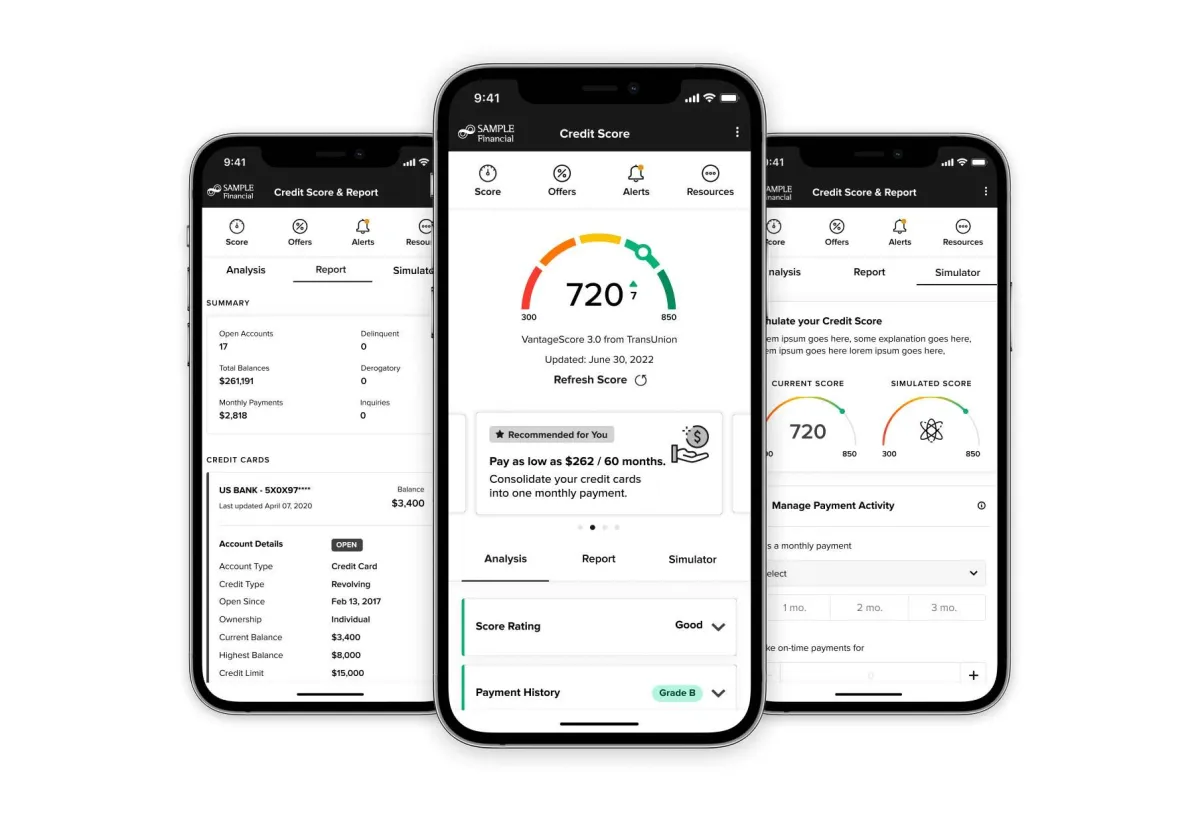

Pull Your Credit Report For Only $1

Start your journey with clarity.

Before we build your custom credit plan, we need to see what we're working with.

Get instant access to your full 3-bureau credit report and scores for only $1 with MyFreeScoreNow.

✅ See all your negative items

✅ Know where your credit stands

✅ Take the first step toward real results

How It Works

3 Simple Steps to Take Back Control of Your Financial Situation

Step 1.

Complete the Qualification Form

Tell us about your personal or business goals and submit your information securely.

This allows us to determine whether you meet the basic criteria for credit optimization and funding readiness before moving forward.

Not everyone qualifies. Screening protects your time and money.

Step 2.

Get Your Credit Profile Assessment & Game Plan

If qualified, we conduct a detailed personal credit profile assessment, including:

- Review of credit reports via MyFreeScoreNow or Experian (3-bureau)

- Analysis of credit age, utilization, limits, inquiries, and derogatory items.

- Identification of gaps preventing bank or lender approval.

- Strategic guidance on utilization reduction, debt positioning, inquiry timing, credit mix, and account optimization

Step 3.

Execute the Strategy With Expert Guidance

You stay in control while we provide ongoing advisory support and step-by-step direction as you execute the plan.

- Apply strategies at the right time.

- Avoid common funding and application mistakes.

- Position your credit profile for stronger approvals.

- Track progress toward funding readiness

You’ll receive a custom advisory game plan tailored to your current profile and goals.

STILL NOT SURE?

FAQ

Frequently Asked Questions

How long does it take to see results from credit repair?

Most clients start seeing initial results within 30–60 days, but full results can take 3 to 6 months depending on your credit history and the complexity of your report.

What’s the difference between credit restoration and credit building?

Credit restoration focuses on removing inaccurate or negative items from your credit report. Credit building involves adding positive accounts (like tradelines or credit cards) to help improve your score and strengthen your profile.

Do I need good credit to start a business or get funding?

Not necessarily. With the right structure, documentation, and strategic funding sources, we can help you access business funding even if your personal credit needs work.

What are tradelines and how can they improve my credit score?

Tradelines are accounts that appear on your credit report (e.g., credit cards, loans). Adding seasoned or primary tradelines can increase your credit age and payment history, boosting your score quickly.

Are primary tradelines better than authorized user tradelines?

Yes. Primary tradelines are accounts where you are the main account holder, which carry more weight. Authorized user tradelines can help, but lenders often look more closely at primary accounts.

What is a shelf corporation and how can it help me get business credit?

A shelf corporation is a pre-established business entity with a history. Lenders often see older businesses as more credible, which can make it easier to qualify for funding and larger credit lines.

How do I know if I qualify for business or personal funding?

We assess your credit profile, income, and business documents during your consultation. From there, we match you with funding programs you're most likely to qualify for.

Can you help me structure my business for better funding opportunities?

Absolutely. We guide you through proper business structure, including your LLC, EIN, business bank account, DUNS number, and more — all tailored to funding readiness.

Will credit repair services remove all negative items from my report?

Yes, our team works aggressively to dispute inaccurate, outdated, or unverifiable items — often with excellent results.

Contact Us

E & A Consulting Group LLC

252 Daniel Webster Hwy #1214

Nashua, New Hampshire 03060

1-888-899-4978

Connect

The credit repair and funding services offered by our company are designed to assist clients in improving their credit profiles and gaining access to potential funding opportunities. Individual results will vary, and we make no guarantees regarding specific outcomes, including achieving a particular credit score such as 700 or higher.

All testimonials featured on this site are from real clients. These examples are provided to illustrate what is possible under ideal circumstances and with full client cooperation. However, they are not intended to represent typical or average results. Your personal credit results depend on a number of factors, including your credit history, current financial status, responsiveness, and the accuracy of information provided.

We strongly encourage you to perform your own due diligence and exercise your own best judgment before making any financial decisions or entering into any agreements. Credit repair and funding involve risk, and there are no guarantees of approval, score increases, or funding amounts.

By using this website, its services, or interacting with any part of our platform (including but not limited to calls, emails, consultations, or social media), you acknowledge and agree that you are solely responsible for the financial decisions you make and the consequences that result.

We do not provide legal, tax, or financial advice. For personalized guidance, you should consult with a licensed attorney, accountant, or financial advisor.

DISCLAIMER

This site is not a part of the Facebook website or Facebook.

Additionally, This site is NOT endorsed by Facebook in any way.

FACEBOOK is a trademark of FACEBOOK, Inc.

© E & A Consulting Group LLC 2023

All Rights Reserved

Facebook

Instagram

Youtube